IR35 Changes: Preparing employers and IT contractors for April 2020

With IR35 regulations due to be rolled-out across the private sector in April 2020, I feel it is the right time to encourage all employers and IT contractors to get their houses in order.

As an IT recruitment consultant that specialises in resourcing and supporting IT contractors for leading UK organisations, I’m often asked for insights into the latest IR35 changes and for help with planning for IT personnel requirements under IR35.

In this article, I’ve tried to address the questions I’m most frequently asked about IR35 and I’ve provided some tips for preparing for its introduction into the private sector.

What is IR35?

HMRC created IR35 regulations to reduce tax avoidance by workers that supply their services to an organisation via an intermediary company. Therefore, this affects many IT contractors that supply their services to clients via their own limited company, an umbrella company, or an IT recruitment agency.

As FT Adviser stated: “When sitting inside IR35, a contractor is deemed ‘employed for tax purposes’, which means they are required to pay income tax and national insurance contributions, just as an employee would.”

IR35 explained in HMRC’s terms read as follows: “A worker is involved in off-payroll working when they work for a client through their own intermediary, often a personal service company (PSC), but would be an employee if they were providing their services directly.

“As off-payroll workers are paid through their own intermediary, they pay Income Tax and National Insurance contributions (NICs) in a different way to an employee.

“The off-payroll working rules are in place to make sure that where an individual would’ve been an employee if they were providing their services directly, they pay broadly the same tax and NICs as an employee.”

HMRC advises that all IT contractors that provide services through an intermediary and all organisations that acquire services through intermediary companies should consider the IR35 regulations carefully.

Currently, Public authorities are responsible for deciding if the IR35 regulations apply to specific projects and services. The contractor, through their intermediary, is required to supply information to the public authority to help them make the decision. If the rules do apply, the public sector employer would be responsible for ensuring any taxes are paid, except if the contractor is supplied through an IT recruitment agency or umbrella company, who would then take-on that responsibility.

In April 2020, the IR35 changes mean that the responsibility for determining the IR35 status of contractors in the private sector will switch to the employer organisation and it is widely expected they will also have the liability for ensuring tax is paid (except when intermediaries like IT recruitment agencies or umbrella companies are involved).

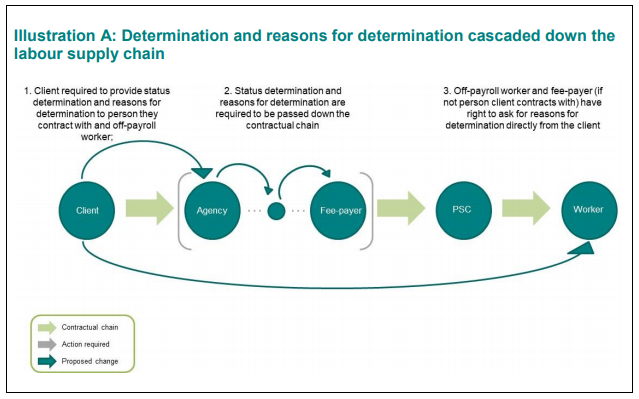

In the public sector, it is currently the employer’s responsibility to convey the IR35 status of the project to the contractor at the start of the contract. The contractor has a right to ask for the reasons for that determination and in response, the employer must provide those reasons in writing within 31 days. Where the employer either does not provide the determination, or the reasons for it within these time scales, the liability for any income tax and NICs due transfers to the employer until they do so.

While the government believes that the existing IR35 rules have worked adequately in the public sector, it considers there are a small number of points that need further consideration before the rules are rolled out more widely. For example, there is currently no requirement for the off-payroll worker to be given a determination by an employer ‘directly’, nor is there any legislative right for the off-payroll worker, or fee-payer to seek the reasons for the determination.

HMRC's inforgraphic demonstrates the responsibility of conveying the IR35 status in the supply chain.

What is HMRC’s definition of an ‘intermediary’?

HMRC defines an intermediary as:

- a worker’s own limited company - known as a personal service company (PSC)

- a partnership – this can include IT recruitment agencies

- another individual

How did IR35 in the public sector affect IT contractors and employers?

IR35 has existed in various guises since 2000, but the introduction of the ‘Off-payroll rules’ in April 2017 certainly created a reaction the IT contracting industry. At Crimson, we saw a larger influx of CVs from public sector IT contractors that wanted to switch into private sector roles. However, we believe that the IR35 reform did not affect the sector as much as had been predicted by some media outlets.

Organisations also reacted to the IR35 reform. Some stopped working with contractors for a period, some began to insist on the blanket operation of PAYE, and some began to use the HMRC IR35 assessment tool on an assignment-by-assignment basis to judge when to apply the regulations.

Come April 2020, we expect less of a reaction by contractors than there was in 2017. This is because there will be fewer alternative options because the laws are already active in the public sector. Nevertheless, we are advising our clients to prepare for the changes by working out what processes will work best for their organisation. We do expect that many IT contractors will look more favourably on opportunities where employers can demonstrate documented evidence that their projects sit outside of the IR35 regulations as well as factors such as detailed information about how the individual was engaged during the project (For example, did they use their own equipment, where they will be working from, how the work will be monitored). It is also a case of ensuring that the following is also covered time, productivity, outputs and obligations as well as the hiring organisation cannot be controlling or directive in anything other than what is in the contract.

How should private sector employers prepare their IT teams for IR35 changes?

Qdoscontractor.com reported: “That nearly 77% of 1400 UK contractors responding to a Qdos survey said they have zero or very little confidence that the private sector will be prepared for these changes will be concerning to the thousands of organisations that rely on these workers, for the skills and flexibility they provide.”

Therefore, Crimson is urging its clients to act now so they won’t be in an uncertain position in April 2020. Employers should assess their risk by considering the following questions:

- How many IT contractors do we currently have?

- What are their roles?

- How are each of the contractors paid?

- When did they start work?

- How does the organisation engage with contractors?

- Are they provided with training?

- Are they asked to rectify substandard work in their own time at no cost?

- What IT projects do we have planned for the next 12 months (and beyond) and what resources will we require?

- What processes do we need to put in place to establish the IR35 facts on an assignment-by-assignment basis?

- Is the hirer dictating the work of the contractor?

Crimson recommend its clients should test on an assignment-by-assignment basis using the HMRC IR35 tool CEST, as this will allow employers to use IT contractors in a demonstrably self-employed way to deliver projects. It will also give organisations the freedom and ability to access the talent they need. However, employers should be mindful that some CEST assessments have been overturned in the courts. Therefore, organisations should ensure they have a good understanding of the IR35 regulations before using the tool. If you would like to find out if the rules apply to your latest project, click here to use the HMRC IR35 tool CEST.

In some circumstances, IT recruitment agencies like Crimson can offer supportive managed service programmes (MSPs) and statement of work (SOW) projects to shoulder the administrative burdens of IR35 for employers. Through these schemes we help employers to assess the incumbent workforce, access the skills they need, and put future processes in place to minimise the risks throughout the supply chain.

In addition, Recruitment & Employment Confederation (REC) has reported that the Government is proposing an exemption for employers that are small companies. It said: “They propose using a definition of small companies similar to the definition used in the Companies Act 2006 which is: a company which in a particular financial year meets two or more of the following conditions: (1) has a turnover of not more than £10.2 million, (2) a balance sheet total of not more than £5.1 million or (3) not more than 50 employees.” Therefore, employers and IT recruitment agencies alike must check whether the employer is a small company, and thus exempt from the IR35 changes.

How should IT contractors prepare for the introduction of IR35 regulations to the private sector?

As an IT contractor, you’ve got a hectic enough schedule and a range of pressures already. You could do without any legal or financial hassles from HMRC due to IR35 infringements. Therefore, we recommend you take the following steps:

- Take the responsibility of swotting-up on the latest IR35 regulations: We suggest reading the most recent guidance from HMRC and setting-up Google Alerts, so you stay abreast of the latest articles on this subject.

- Review your current working processes: Once you have a good understanding of the pitfalls of IR35, analyse the way you operate and make any changes necessary to ensure you can accurately complete the IR35 assessment test. Before making any major changes, be sure to consult with your lawyer and your accountant for advice.

- Consider working with an umbrella company: At Crimson, our group policy is that all public sector contractors that operate within the IR35 regulations must provide services via a recommended HMRC compliant umbrella company. This may apply to private sector roles come April 2020.

- Buy insurance: Just because you are operating correctly, some organisations may not be. Tax enquiries can be drawn out and expensive processes. Make sure you are covered should any issues arise.

- Use CEST yourself: Never assume that your assignment will pass the CEST test, nor that your client’s information is correct. Use the HMRC IR35 tool before embarking on any new contract to be sure of your status.

Next steps

We expect the draft legislation to be published in summer 2019, with a view to it being finalised in December 2019, which won’t give employers, contractors, or intermediaries much time to prepare. Therefore, it is wise for all parties to keep their ears to the ground and begin to plan the best they can for IR35 in the private sector.

Crimson is offering clients a Discovery Meeting to help you explore the risks and opportunities of the changing regulation. You can learn more and make contact here.

Crimson is an IT consultancy, an IT solutions provider, an IT recruitment agency, and a Microsoft Gold Partner operating across the UK.